Canada has recently made a significant move by rescinding its digital services tax (DST) as part of an effort to advance trade negotiations with the United States. This announcement came from Canada's finance ministry in a statement released on Sunday. The decision to abolish the DST is seen as a strategic step intended to facilitate discussions that could lead to improved economic relations between the two neighboring countries.

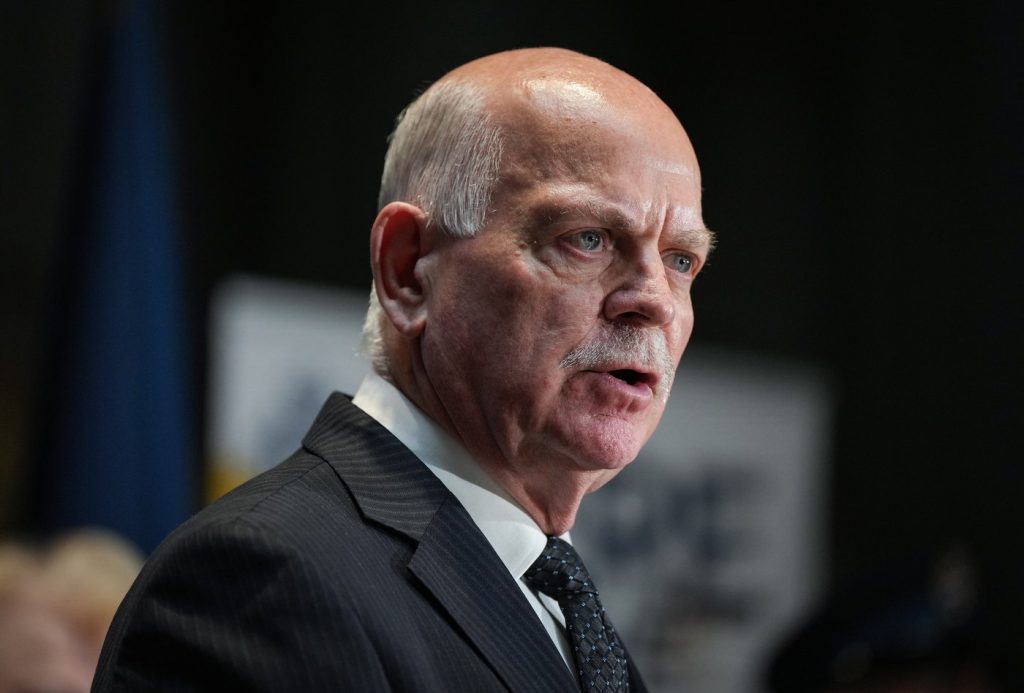

François-Philippe Champagne, the Minister of Finance, expressed in a social media post that “resigning the DST will allow the negotiations to make vital progress and reinforce our work to create jobs and build prosperity for all Canadians.” The Minister's remarks highlight the government's focus on fostering economic development while engaging in complex trade negotiations.

The context for this decision is rooted in ongoing discussions between Canada and the U.S., aimed at establishing a new economic and security partnership. According to the finance ministry, Prime Minister Carney and President Trump have come to an agreement for their respective teams to resume negotiations, with a target date set for July 21, 2025. This timeline establishes a clear deadline for reaching an accord as both nations seek to bolster bilateral cooperation.

The digital services tax that Canada had proposed would have imposed a levy on major technology companies operating within its borders, such as Meta, Amazon, Google, Airbnb, and Uber. This tax was designed to capture revenue generated by these companies from their interactions with Canadian users, reflecting a growing trend among nations to regulate the digital economy more effectively. However, the potential implementation of the DST faced criticism and resistance from both the targeted companies and the U.S. government, prompting Canada to reconsider its approach.

By retracting the DST, Canada aims to create a more conducive environment for negotiation, potentially easing tensions with the U.S. This move is indicative of a broader goal to optimize economic growth and job creation within Canada, while simultaneously enhancing diplomatic ties with its southern neighbor. The implications of this decision extend beyond immediate trade discussions; they may also influence how digital services are taxed in the future, not just in Canada but across similar economies worldwide. The outcome of these negotiations could set a precedent for other countries grappling with the balance between fair taxation and fostering innovation in the tech sector.

As Canada takes this step, all eyes will be on the upcoming talks with the U.S., as both nations work towards establishing a precarious balance between regulation and growth in an evolving economic landscape. This development is particularly noteworthy as it reflects the shifting dynamics of international trade relations and the complexities associated with taxing digital businesses that operate across borders.