DEARBORN, Mich. (AP) – Ford Motor Co. has announced that it anticipates a significant impact on its operating profit due to tariffs, estimating a hit of approximately $1.5 billion for the current year. This financial forecast led the company to withdraw its full-year financial guidance amid the ongoing uncertainty surrounding the trade policies under the Trump administration.

The automaker disclosed on Monday that its net income plummeted by nearly two-thirds in the first quarter, falling to $473 million, or 12 cents per share, compared to $1.33 billion, or 33 cents per share during the same period a year prior. Additionally, Ford reported a 5% decline in revenue, amounting to $40.66 billion. These results, however, exceeded the expectations of analysts surveyed by FactSet, who had predicted stable earnings per share and estimated revenue at $38.02 billion. Despite these stronger-than-expected results, Ford's stock experienced a drop of more than 2% in after-hours trading.

Last week, General Motors indicated that it is preparing for a potential tariff-related impact as high as $5 billion by 2025. In comparison, both Ford and Tesla are expected to face a lesser impact from these tariffs due to their higher proportion of domestic vehicle assembly. Nonetheless, the financial burden they do experience from the tariffs is anticipated to be anything but trivial.

Originally, Ford projected earnings before interest and taxes for 2025 to range between $7 billion and $8.5 billion. However, the company recognized that the risks posed by tariffs make it difficult to maintain accurate financial guidance for the full year, given the potential variability in outcomes. While addressing analysts during an earnings call, CEO Jim Farley emphasized the advantage that higher levels of domestic production provide to Ford, reiterating that the repercussions of the evolving trade landscape are still unfolding.

“It's too early to gauge the related market dynamics, including the potential industry-wide supply chain disruptions,” said Farley. He noted that automakers with the largest U.S. manufacturing footprint, which includes Ford, will likely have a significant advantage going forward. His assertiveness about the company's positioning reflects an optimistic outlook amidst uncertain conditions.

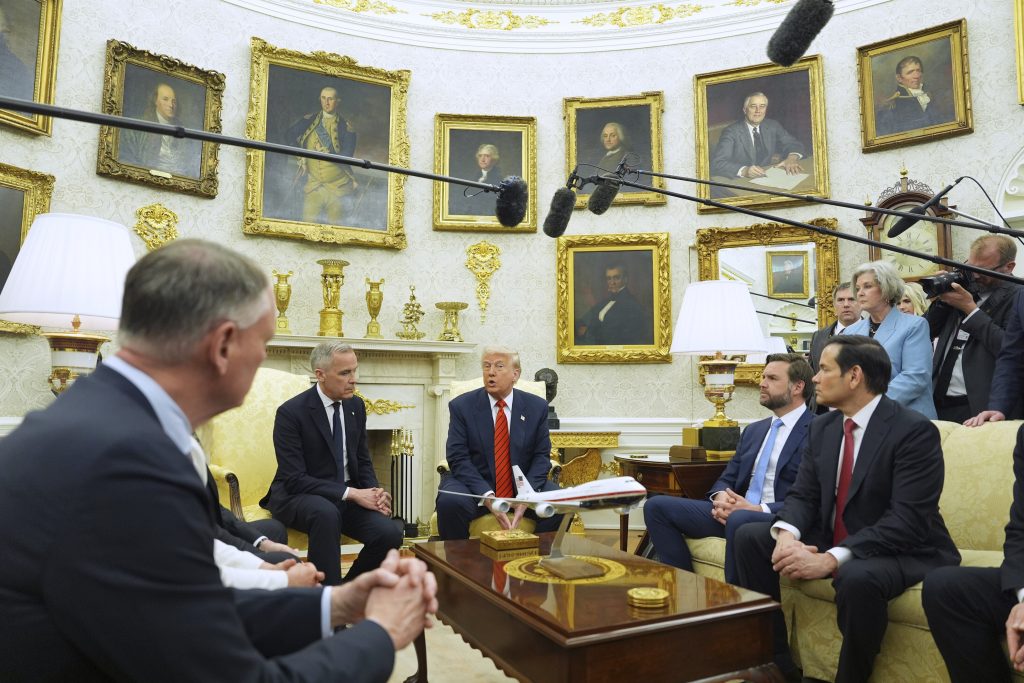

President Donald Trump has articulated a goal of reshoring manufacturing, particularly in the auto industry, back to the United States. Recent executive orders signed by Trump aim to relax some of the 25% tariffs imposed on automobiles and auto parts, allowing automakers additional time to adapt their manufacturing processes accordingly.

Nevertheless, both automakers and independent studies have suggested that these tariffs could have adverse effects, such as raising prices, driving down sales, and undermining the global competitiveness of U.S. manufacturing. The discussion surrounding the tariffs dominated Ford's earnings call, with executives highlighting that even minor disruptions in the supply chain could lead to substantial challenges in production.

Chief Operating Officer Kumar Galhotra pointed out that the issue of rare earth materials imported from China has become increasingly complicated recently. He explained that disruptions in acquiring just a few essential components could significantly affect Ford's production capabilities.

As the situation evolves, the auto industry continues to brace for the potential ramifications of new tariffs and trade regulations, comprehensively affecting production strategies and financial forecasts across the sector.