HONG KONG (AP) - China's economy showcased a 5% annual growth in 2025, supported significantly by robust export activities despite the tariffs imposed by U.S. President Donald Trump. However, the momentum appeared to wane as growth softened to a rate of 4.5% in the last quarter of the year, marking the slowest quarterly expansion since late 2022 when China was beginning to ease stringent COVID-19 restrictions. This slowdown followed a growth rate of 4.8% in the previous quarter.

The Chinese government has been striving to stimulate faster economic growth following a downturn in the property market and the lingering disruptions caused by the pandemic. This annual growth rate for 2025 aligns with the official target set by the government for a 5% expansion.

In terms of quarterly performance, the economy recorded a growth of 1.2% in the October to December period. The strong export figures proved compensatory for sluggish consumer spending and weak business investment, leading to a record trade surplus of $1.2 trillion. Although exports to the U.S. faced challenges due to Trump's tariffs, this decline was mitigated by increased shipments to other global markets. Some governments, in turn, have begun to take measures to protect local industries by raising import duties on Chinese goods.

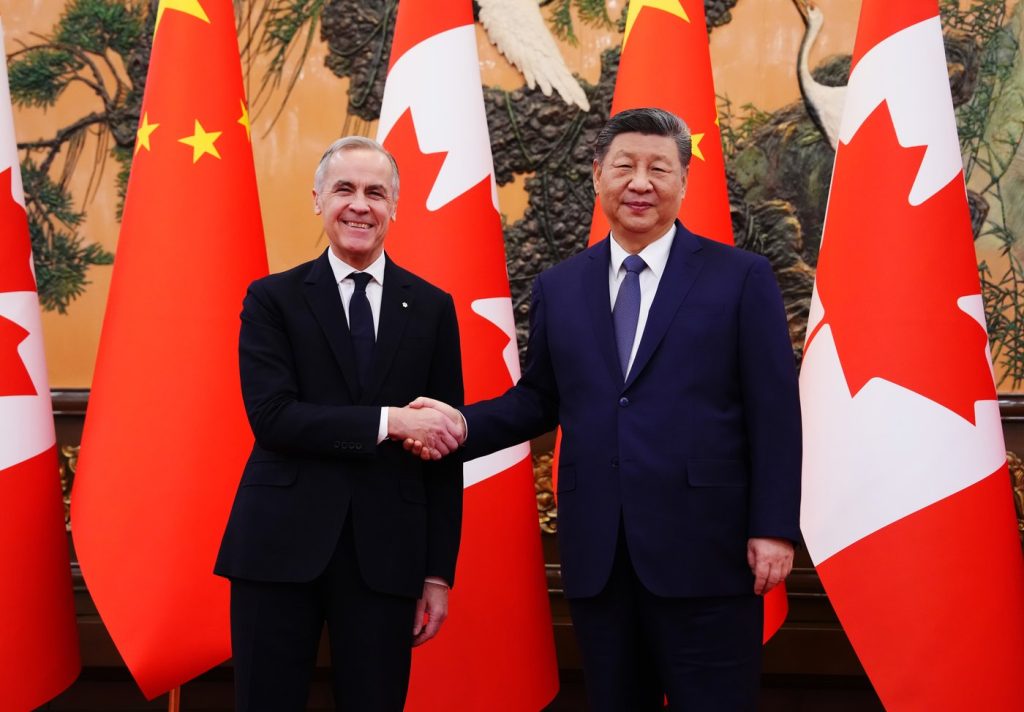

Despite the obstacles, agreements between Trump and Chinese leader Xi Jinping regarding a truce in their ongoing tariff battle have provided some relief to China's export pressures. Nonetheless, Chinese exports to the U.S. still saw a substantial decline of 20% last year. Lynn Song, chief economist for Greater China at ING, expressed concerns about the sustainability of growth driven solely by exports, indicating that escalating tariffs from other economies could tighten the pressure on China.

Chinese officials have emphasized the need to bolster domestic demand, but efforts thus far have shown limited effectiveness. A trade-in program aimed at encouraging drivers to switch to more energy-efficient vehicles has lost traction, reflecting broader issues in stimulating consumption. Chi Lo, a market strategist at BNP Paribas Asset Management, pointed out that stabilizing the domestic property market is crucial for revitalizing public confidence, which directly impacts household consumption and private investment.

Moreover, China has implemented trade-in subsidies for essential home appliances. While these consumer stimulus policies, including corresponding subsidies, are set to continue into 2026, predictions suggest a potential scaling back, as noted by Weiheng Chen from J.P. Morgan Private Bank.

Investment in advanced technologies, such as artificial intelligence, remains a pivotal focus for the ruling Communist Party as it seeks to enhance self-reliance and compete with the U.S. However, many small businesses and ordinary citizens are grappling with financial hardships and uncertainties regarding employment and income. Liu Fengyun, a noodle restaurant owner in Guizhou province, lamented the difficulties her business faces, stating that customers are finding alternative, cheaper meal options at home.

Kang Yi, the head of China’s National Bureau of Statistics, announced that despite facing several pressures, China's economy had maintained “steady progress in 2025” and had established "solid foundations" for counteracting risks. However, some economists speculated that the actual growth figures may be overstated. The Rhodium Group suggested an expected growth of only 2.5% to 3% for the year.

China’s economy had shown a 5% growth rate in 2024, and 5.2% in 2023 reflects a downward trend in ambitious government targets over recent years, which have gradually decreased from 6% to 6.5% in 2019 down to around 5% by 2025. A further slowdown is anticipated for 2026, with Deutsche Bank projecting a growth rate of approximately 4.5% for that year.

Maintaining a robust and stable economy is deemed essential for social stability, a top priority for China's leaders. While it is believed that social stability can be preserved even with lower growth rates, there remains a strong desire for the economy to continue expanding. Analysts, such as Neil Thomas from the Asia Society Policy Institute, suggest that China must sustain around 4% to 5% annual growth to meet its stretch target of achieving a gross domestic product (GDP) per capita of $20,000 by 2035.